Is Homeowners Insurance Required?

If you’re buying a home in Colorado Springs, you might wonder if homeowners insurance is truly necessary. In this post, we’ll cover why most mortgage lenders (including 719 Lending) expect you to have it, how it protects your investment, and what specific considerations apply here in Colorado.Unders

Read MoreHow to Track Housing Data to Anticipate Market Trends

Summary: In this post, we’ll explore how tracking real-time housing data—especially in markets like Colorado Springs—can give you a clearer sense of upcoming trends in mortgage demand, home sales, and inventory. By the end, you’ll understand how to use this information to confidently navigate the lo

Read MoreRefinancing a Mortgage in Forbearance

Summary: In this post, we’ll explore the evolving landscape of mortgage forbearance rules—especially the changes following the 2008 financial crisis and the adjustments made during and after the 2020 COVID-19 pandemic. We’ll explain what it means to refinance while in or after forbearance, highlight

Read More-

In this guide, we’ll break down the essentials of FHA loan closing costs in Colorado Springs. You’ll learn what factors influence these expenses, how to prepare financially, and discover practical strategies to reduce them. By the end, you’ll feel confident navigating your closing costs, armed with

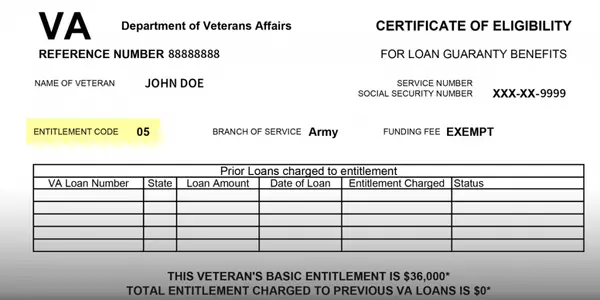

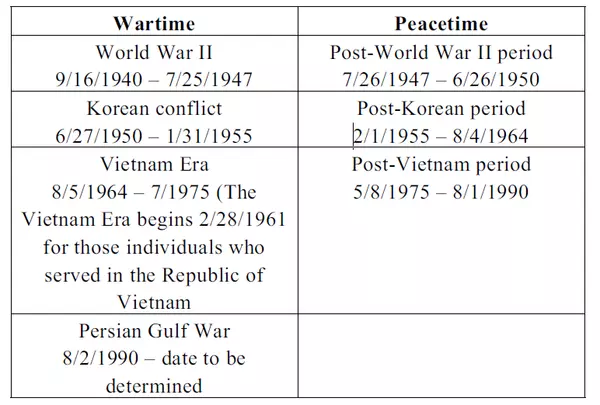

Read More Understanding VA Entitlement Codes

Are you considering a VA loan in Colorado Springs? If so, you’ve probably heard about something called “VA entitlement codes.” These codes help determine your eligibility for a VA home loan and can play a major role in shaping your financial future. In this post, we’ll break down what VA entitlement

Read MoreUnderstanding VA Loan Eligibility and Entitlement

Thinking about using your VA loan benefit in Colorado Springs? Before you start touring homes, it’s important to understand two key concepts: eligibility and entitlement. These determine whether you can tap into the powerful features of a VA loan—including zero down payment—and how much you can borr

Read MoreLaying the Groundwork: Your Path to VA Homeownership

Thinking of buying a home with your VA loan benefit in Colorado Springs? Before you begin scrolling through real estate listings, it’s crucial to lay a solid foundation. Homeownership brings independence, financial opportunities, and stability. Yet, it also carries serious responsibilities and costs

Read MoreYour Comprehensive Guide to VA Homeownership Preparation

Are you a veteran or military family planning to use your VA loan benefit for a home in Colorado Springs? Making the jump from renting to homeownership is an exciting milestone, but it also comes with responsibilities that require careful thought and preparation. In this post, we’ll dive deep into t

Read MorePreparing for VA Homebuying in Colorado Springs

Are you getting ready to purchase a home with a VA loan in Colorado Springs? Taking the leap into homeownership is a significant decision, and doing it right requires thorough preparation. This post will walk you through what it means to become financially and emotionally ready for a VA home purchas

Read MoreVA Loans: Your Guide in Today’s Market

Wondering if VA loans are right for you in today’s housing market? In this post, we’ll explain what VA loans are, why they remain popular among veterans, and how they fit into the broader real estate landscape. We’ll also look at the benefits, especially for buyers in places like Colorado Springs, a

Read MoreYour Guide to a VA Appraisal in Colorado Springs

Are you exploring a VA loan in Colorado Springs? Understanding the VA appraisal is a key step in securing the right home. In this post, we will explain what a VA appraisal is, how it differs from a home inspection, the role it plays in the Colorado Springs real estate market, and how you can best pr

Read MoreEasyKnock – Leaseback Platform Closes: What It Means for Buyers

Summary:A prominent sale-leaseback platform, EasyKnock, has recently closed its doors, raising questions for homeowners across Colorado Springs and beyond. This sudden shutdown, fueled by legal challenges and consumer complaints, highlights the importance of choosing trustworthy mortgage professiona

Read MoreWhy Aren’t Millennials Buying Homes?

Summary:Millennials are entering the housing market more slowly than previous generations, and new research sheds light on why. In Colorado Springs, many first-time buyers face unique challenges—credit issues, uncertainty about the mortgage process, and struggles with saving for a down payment. This

Read MorePotential TikTok Ban: Colorado Springs Mortgage Impact

Summary:A potential TikTok ban could take effect soon, changing how mortgage professionals connect with homebuyers in Colorado Springs. This post explains what might happen if TikTok disappears, how it could affect first-time buyers who rely on social media for mortgage advice, and why it matters fo

Read MoreVA Home Loan Mortgage: Pros & Cons

Pros and Cons of a VA Home Loan MortgageNavigating the path to home ownership is like embarking on an inspiring journey, much like Kevin’s own triumphant story.He recently discovered how a VA home loan mortgage could accelerate his dream of owning a home in Colorado Springs, with the guidance of 719

Read MoreCan You Buy A House After Bankruptcy?

Summary:If you’ve gone through bankruptcy, you might think that owning a home in Colorado Springs is out of reach. Thankfully, that’s not always true. In this guide, you’ll learn how to rebuild your credit, understand waiting periods, and make strategic moves toward qualifying for a mortgage even af

Read More-

Summary:Buying a house with student debt can feel challenging, but it’s more achievable than you might think. This guide offers practical strategies for managing student loans, improving your credit, and securing a mortgage—especially if you’re interested in the Colorado Springs market. You’ll learn

Read More -

First-Time Homebuyer TipsSummary:Buying your first home can feel both thrilling and a bit overwhelming. Where do you start, what steps should you take, and how can you ensure you’re making the right choices? In this guide, you’ll find practical first-time homebuyer tips tailored for those looking in

Read More Are Closing Costs Tax Deductible?

Are Closing Costs Tax Deductible?Summary:When you buy a home, you might wonder if the closing costs you pay can help reduce your tax bill. This article explains which closing costs might be tax deductible, how they work with your mortgage, and what first-time homebuyers in Colorado Springs should k

Read MoreHow to Prepare Financially for Buying a Home in the New Year

As the New Year approaches, many people set resolutions to achieve major life goals—and buying a home often tops the list. If you’re planning to purchase a home in the coming year, taking steps now to prepare financially can make the process smoother and more rewarding. Here are some key tips to hel

Read More

Categories

Recent Posts