Best Time to Buy a Home in 2025

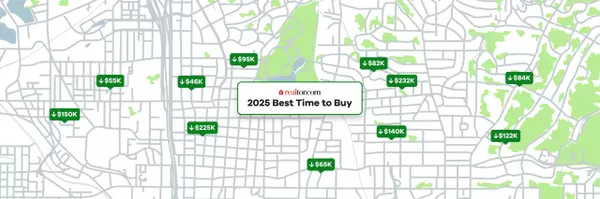

October could bring the best deals of the year — especially in Colorado Springs. Here’s how to prepare. Original Article Here Why This October Matters for Homebuyers Buying your first home can feel overwhelming — especially with rising prices and interest rate uncertainty. But according to Realto

Read MoreCozy Colorado Home Feature Trends

10 Cozy Colorado Springs Home Features Buyers Want This Fall When the air gets crisp and the leaves turn golden, homebuyers in Colorado Springs start dreaming of cozy spaces. If you’re selling—or simply upgrading your own home—here are the top features buyers love in the fall. 🏡 10 Must-Have Fall

Read MoreColorado Springs Fall Market Update: What Buyers and Sellers Should Know

Colorado Springs Fall Market Update: What Buyers & Sellers Should Know Fall is here in the Pikes Peak region, and with the cooler air comes a shift in the real estate market. While summer tends to bring peak activity, autumn has its own advantages for both buyers and sellers. Here’s what you need to

Read MoreFall in Love with Your Home: Staging Tips for a Colorado Springs Sale

Fall in Love with Your Home: Staging Tips for a Colorado Springs Sale When autumn arrives in Colorado Springs, the city comes alive with golden aspens, crisp mornings, and stunning views of Pikes Peak framed in fall colors. While many homeowners think spring and summer are the only times to sell, f

Read MoreFall Fun in the Pikes Peak Region

Fall Fun in the Pikes Peak Region: Best Local Events & Why Living Here is Special One of the best parts of living in our city and the surrounding areas is the sense of community—and fall is the perfect time to enjoy it. Whether you’re into food, festivals, or spooky traditions, there’s something fo

Read MoreUnderstanding the Tax Benefits of Homeownership

Owning a Home Comes with More Than Just Pride Homeownership is one of the biggest financial steps many people take—and while the long-term benefits include building equity and stability, there are also potential tax advantages that can help homeowners save money each year. Knowing what’s available

Read MoreShould You Make Extra Mortgage Payments? What to Know

Paying Down Your Mortgage FasterFor many homeowners, making an extra mortgage payment here and there seems like a smart move—and in many cases, it is. Paying a little more toward your principal can shorten the life of your loan and reduce the total amount of interest paid.But before you start sendin

Read MoreHow to Stay Focused During a Busy Homebuying Season

Summer Brings More Than SunshineSummer is one of the busiest seasons for homebuying. With school out, vacation time available, and longer days to house hunt, many buyers hit the market during this time of year. While it’s a great time to buy, the pace can feel fast—and sometimes overwhelming.If you’

Read More-

These days staying well isn’t just about hitting the gym or eating healthy, it’s about managing your energy, stress, habits, and mindset with intention. So, where does AI come in? If you were hoping it could magically take that 6 pm Pilates class for you, that’s a no, but AI powered personal wellnes

Read More Summer Home Maintenance Tips Every Homeowner Should Know

Why Seasonal Maintenance MattersAs the weather heats up, it’s a good time to give your home a little extra attention. Just like spring cleaning, summer home maintenance helps protect your property, improve energy efficiency, and avoid costly repairs down the road.Whether you’re a first-time homeowne

Read MoreSpring Cleaning Tips That May Boost Your Home’s Value

A Fresh Start, Inside and OutSpring cleaning isn’t just about dusting and decluttering—it’s an opportunity to enhance your home’s appeal, functionality, and even its value. Whether you’re staying put or considering a future sale, giving your home a seasonal refresh is a smart move that can pay off i

Read MoreIs Spring the Right Time to List Your Home? Here’s What to Consider

Spring Brings More Than Just SunshineAs the weather warms up and the days get longer, many homeowners start asking the same question: Is spring the best time to sell? Traditionally, the answer has been yes—and for good reason.Spring breathes new life into the housing market. Homes look their best wi

Read MoreWhat Is Escrow and Why Do I Need It?

Understanding Escrow AccountsWhen you’re buying a home, you’ll hear a lot of new terms—one of the most important is “escrow.” While it might sound technical, escrow is simply a tool that helps manage and protect certain parts of your mortgage and homeownership.An escrow account is set up by your mor

Read MoreCredit Health and Mortgages: What to Know Before You Apply

Credit Matters More Than You ThinkWhen preparing to buy a home, your credit score becomes more than just a number—it’s a key part of your financial identity. While it’s not the only factor in qualifying for a mortgage, it plays a major role in determining what loan products might be available to you

Read MoreSpring 2025 Housing Market: What Buyers Need to Know

Why Spring is a Prime Time for Real EstateSpring consistently ranks as one of the most active seasons in real estate—and for good reason. The weather improves, daylight lasts longer, and families often prefer to move before the next school year. In 2025, we’re seeing a particularly energized market

Read MoreShould You Buy a Home and Renovate or Buy Move-In Ready?

When it comes to buying a home, one of the big decisions many buyers face is whether to purchase a fixer-upper and renovate or go for a move-in-ready property. Both options have their pros and cons, and the right choice really depends on your goals, timeline, and comfort level.Buying a Fixer-Upper:

Read MoreHow to Improve Your Mortgage Approval Chances

Getting approved for a mortgage is an exciting step toward homeownership, but it requires careful financial planning. Lenders look at various factors to determine your eligibility, and small improvements can make a big difference. If you’re preparing to apply for a mortgage, here are some key steps

Read MoreAchieving Real Estate Success: The Essential Practices of Self-Integrity and Accountability

In the world of business, Success is about building a foundation of trust, reliability, and excellence. I often emphasize two critical concepts that serve as the bedrock of a successful career: Self-Integrity and Accountability. These two principles are not just abstract ideals; they’re actionable c

Read MoreCommon Mortgage Myths Debunked

When it comes to getting a mortgage, there’s no shortage of misinformation. Many homebuyers, especially first-timers, hesitate to apply because they believe common myths that simply aren’t true. To help you move forward with confidence, let’s debunk some of the most widespread mortgage myths.Myth #1

Read MoreHow to Choose the Right Mortgage Lender or Broker

Choosing the right mortgage professional is a critical step in the home-buying process. Whether you work with a mortgage lender or a mortgage broker, the decision can impact your loan options, interest rate, and overall experience. Here’s how to determine which option is best for you and what to loo

Read More

Categories

Recent Posts