-

Creating a truly childproof-house can feel overwhelming. However, with the right baby proofing strategies, you can keep your child safe at every stage. This guide offers safety essentials to help you tackle potential hazards room by room, ensuring peace of mind for the whole family—whether you’re in

Read More -

Essential Home-Buying-AdviceAre you ready to begin the buying process in Colorado Springs or anywhere in Colorado? This post provides home buying tips and home-buying-advice on how to work with mortgage lenders, calculate closing costs, and partner with a real estate agent. Below, we’ll cover monthl

Read More Key Tips for VA Disability Benefits: Military Disability Compensation

What You’ll Learn: In this post, we’ll explore how military disability compensation works, why it matters for Colorado Springs homebuyers, and how these benefits can affect your mortgage journey. We’ll also touch on where to find updated rate tables, what these payments mean for your monthly finance

Read More15-Year vs. 30-Year Mortgage: Which One is Right for You?

Choosing the right mortgage term is a critical decision in the home-buying process. The two most common options are the 15-year and 30-year fixed-rate mortgages. Each has its own set of advantages and drawbacks, and understanding these can help you decide which one aligns with your financial goals.T

Read MoreBuying a House: When to Wait (and When Not to Wait) in Colorado Springs

If you’re pondering when to make the leap into the Colorado Springs housing market, you’re not alone. You might be weighing the pros and cons of market conditions, interest rates, and personal circumstances. In this post, we’ll explore when it might make sense to wait and when it may be wise to move

Read MoreWhat to Look for When Touring a House

Are you ready to find the perfect home in Colorado Springs or anywhere in Colorado? Touring a house is an exciting step, yet it can also feel overwhelming. An open house is a public event hosted by the listing agent, allowing potential buyers to casually tour the home for sale. In this guide, we’ll

Read More-

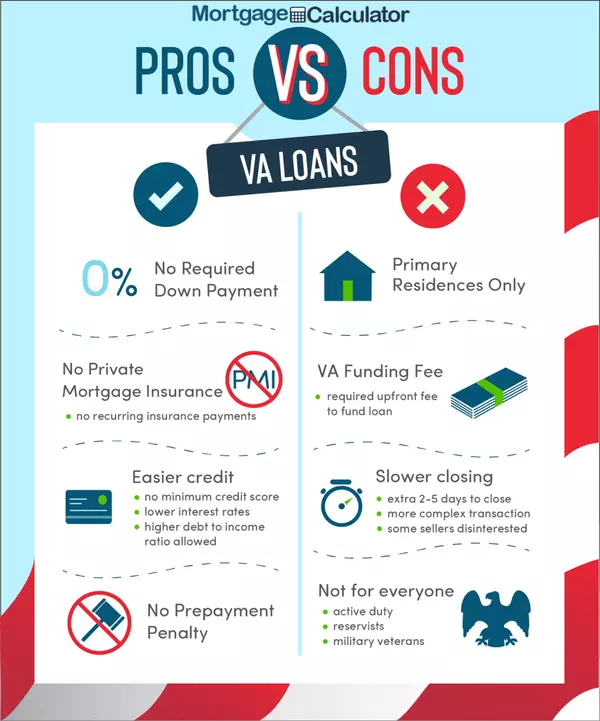

Considering a VA loan in Colorado Springs? In this post, we’ll explore the key benefits and drawbacks of VA loans and show you how 719 Lending can help you navigate the process in Colorado.What You’ll Learn About VA MortgageWhat a VA loan is and why it’s valuableThe most important pros and cons to c

Read More VA Loan Residual Income Explained

VA Residual Income: Colorado Springs GuideAre you curious about how the Department of Veterans Affairs (VA) calculates your finances before granting a VA home loan? In this post, we’ll explain VA residual income and show you why it matters for homebuyers in Colorado Springs and throughout Colorado.

Read MoreHow to Secure a VA Construction Mortgage for Your New Home

Looking to build your dream home as a veteran? A VA construction mortgage can help you get started with no down payment and no PMI. This guide walks you through the benefits, eligibility, and steps to secure a VA construction mortgage.Key TakeawaysVA construction mortgages offer benefits such as no

Read More-

Are you curious about FHA mortgage insurance and how it affects your home loan in Colorado Springs? Understanding the mortgage insurance premium rates is crucial for evaluating the overall cost of your FHA mortgage insurance. In this post, we’ll explain what FHA mortgage insurance is, how it works,

Read More Managing VA Home Loans and Divorce: Essential Tips and Guidance

Divorce and VA home loans and divorce often come with many questions. How does divorce impact your VA mortgage? Can you assume or refinance the loan? Understanding VA loan rules and state laws is crucial, as these regulations govern how VA loans can be managed among spouses and affect eligibility fo

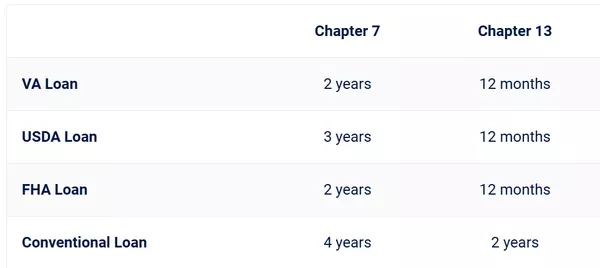

Read MoreBest Practices for Getting a VA Loan After Bankruptcy

Can you get a VA loan after bankruptcy? Yes, it is possible. VA loans have flexible criteria that can help veterans re-establish their financial footing. This guide covers eligibility after Chapter 7 and Chapter 13 bankruptcies, the required waiting periods, and steps to rebuild your credit for impr

Read MoreUnderstanding VA Loan Eligibility: A Simple Guide for Veterans

Are you eligible for a VA loan? This guide covers the basic requirements, different service statuses, and how to get your Certificate of Eligibility. Find out if you qualify for VA loan eligibility.Key TakeawaysVA loans are accessible to eligible veterans and service members, requiring a Certificate

Read MoreUnderstanding FHA Allowable Fees:

Understanding FHA Allowable Fees:Understanding FHA allowable fees and the role of your mortgage lender is essential when taking out an FHA loan. These costs include mortgage insurance and origination fees, which can impact your overall budget. This article will help you grasp these fees and manage y

Read Moreone-time close vs two-time close construction loan

One Time Close vs Two Time Close Construction Loan: Which is Best for You?When planning to build a home, understanding the right construction loan for your project is crucial. The main decision often comes down to choosing between a One Time Close vs Two Time Close Construction Loan. This guide will

Read MoreUnmissable Colorado Springs Attractions for 2025

Must-See Colorado Springs Attractions for Every TravelerColorado Springs Top 10 Attractions: 10 Must SeeColorado Springs has it all—breathtaking mountain views, cultural hotspots and some of the best outdoor recreation in the country. Whether you’re a first timer or a long time resident looking for

Read MoreUnderstanding Closing Costs: What Every Buyer Should Know

Buying a home is an exciting journey, but it comes with its share of expenses—one of which is closing costs. Many first-time buyers are surprised by these additional costs, which can add up to thousands of dollars. As a mortgage professional, I’m here to break down what closing costs are, what they

Read More2025 VA Home Loan Insights: What Veterans Need to Know

Summary: If you’re a veteran, active-duty service member, or surviving spouse looking to buy or refinance a home in Colorado Springs, a VA loan is likely your strongest financing option. This comprehensive guide will cover everything about VA loans—from qualification and benefits to navigating the l

Read MoreSenate Passes Trigger Leads Bill, Next Stop: The House

What’s new? On December 18, 2024, the Senate passed the Homebuyers Privacy Protection Act (S. 3502), a bipartisan bill aimed at limiting “abusive” digital marketing practices tied to trigger leads. After some initial setbacks—like being removed from a military spending bill—the measure made it throu

Read MoreUnderstanding Loan-Level Price Adjustments – LLPAs in Colorado

Summary:In this post, we’ll explain what Loan-Level Price Adjustments (LLPAs) are, why they matter for homebuyers and homeowners in Colorado Springs, and how they influence mortgage costs. We’ll discuss real examples from Fannie Mae’s official LLPA matrix, show how different levels of buyers are imp

Read More

Categories

Recent Posts