Mortgage 101 – Your Statring Guide To Home Finanace

Purchasing a home represents the largest financial commitment most people make, making mortgage knowledge essential for success. With over $12.5 trillion in outstanding mortgage debt in the U.S. alone, understanding how mortgages work can save you tens of thousands of dollars and help you make informed decisions about your financial future.

This comprehensive guide covers everything from basic mortgage definitions to advanced repayment strategies, current market trends, and international comparisons. Whether you’re a first time homebuyer or considering refinancing your existing home loan, you’ll find practical insights to navigate the complex world of home financing.

Introduction to Home Loans

Home loans, commonly referred to as mortgages, are financial agreements that make homeownership possible for millions of people. In a typical mortgage loan, a lender—such as a bank, credit union, or mortgage broker—provides the funds needed to purchase or refinance a property. In return, the borrower agrees to repay the loan amount, plus interest, over a set period known as the loan term.

The interest rate on a home loan determines how much you’ll pay in addition to the original loan amount, and it can be fixed or variable depending on the loan type. The loan term, often 15 or 30 years, defines how long you have to repay the mortgage. Throughout this period, borrowers make regular monthly payments that cover both the principal (the amount borrowed) and the interest charged by the lender.

Understanding the basics of home loans—including how interest rates, loan terms, and loan amounts work—empowers you to make informed decisions as you navigate the mortgage process. Whether you’re a first-time homebuyer or considering refinancing, knowing how these elements interact is key to finding the right mortgage for your needs and budget.

What is a Mortgage?

A mortgage is a specialized loan that enables individuals to purchase real estate by using the property itself as collateral. This legal agreement gives lenders the right to foreclose and seize the property if the borrower defaults on mortgage payments, making it a secured form of debt.

Unlike other loans, mortgages are specifically designed for real property purchases and typically involve monthly payments of both principal and interest over extended terms ranging from 15 to 30 years. The mortgage serves as both a financing tool and a legal instrument that protects the lender’s investment while allowing borrowers to spread the cost of homeownership over many years.

When you secure a mortgage loan, you’re essentially entering into a contract where the financial institution provides the necessary funds to purchase the home, and you agree to repay that amount plus interest according to specified terms. The mortgaged property serves as security for the loan, which is why mortgage rates are typically lower than unsecured debt like credit cards or personal loans.

The mortgage structure includes several key components: the loan principal (the original borrowed amount), interest charges calculated on the outstanding balance, and often additional costs like property taxes and homeowner’s insurance collected through escrow accounts. In addition to these, other costs such as maintenance or association fees may also be included in the total cost of homeownership. This arrangement ensures that essential housing costs are managed systematically throughout the loan term.

Types of Mortgage Loans

The mortgage market offers various loan products designed to meet different financial situations and borrower needs. Understanding these options helps you select the most appropriate financing for your circumstances and long-term goals. Some mortgage products, such as package loans, may also finance personal property like furnishings or appliances as part of the overall loan agreement.

Fixed-Rate Mortgages

Fixed rate mortgages maintain the same interest rate and monthly payment amount throughout the entire loan term. This stability makes budgeting predictable and protects borrowers from rising interest rates. Most lenders offer 15-year and 30-year terms, with 30-year fixed rate mortgages being the most popular choice among American homebuyers.

The consistent payment structure of fixed rate mortgage products appeals to borrowers who plan to stay in their homes long-term or prefer payment certainty. While initial rates may be higher than adjustable rate mortgages, fixed-rate loans eliminate the risk of payment increases due to market fluctuations.

Adjustable-Rate Mortgages

Adjustable rate mortgages feature interest rates that change periodically based on market conditions. These loans typically start with a fixed rate for an initial period (commonly 5, 7, or 10 years), then adjust annually according to a specific financial index plus a predetermined margin. When the rate adjusts, the new interest is calculated using the current monthly rate, which directly affects the monthly payment amount.

Adjustable rate mortgage products often begin with lower rates than fixed-rate alternatives, making them attractive for borrowers who plan to move or refinance before the rate adjustments begin. However, monthly payments can increase significantly after the initial fixed period, creating potential affordability challenges.

Government-Insured and Guaranteed Loans

Government-insured or guaranteed programs provide mortgage access for borrowers who might not qualify for conventional financing. These loans reduce lender risk and enable more flexible qualification requirements.

FHA Loans: The Federal Housing Administration (FHA) insures these mortgages, allowing down payment amounts as low as 3.5% with credit scores of 580 or higher. FHA also permits credit scores between 500 and 579 with a 10% down payment, though such loans are less common. Borrowers must pay mortgage insurance premiums throughout the loan term, increasing total housing costs.

VA Loans: Available to eligible veterans and service members through the U.S. Department of Veterans Affairs (VA), these loans are guaranteed by the VA but originated by private lenders. VA loans require no down payment and do not require private mortgage insurance. The primary cost is a one-time funding fee that can be financed into the loan amount. Those interested in projecting their potential monthly mortgage payments and understanding the long-term impact of different loan structures can use a specialized calculator.

USDA Loans: Designed for rural and suburban properties, these loans offer zero down payment options for qualified borrowers in eligible areas. Income limits and geographic restrictions apply, but successful applicants can achieve homeownership without substantial upfront costs.

Conventional vs Government-Insured or Guaranteed Mortgages

Conventional mortgages meet the standards set by Fannie Mae and Freddie Mac, the government-sponsored enterprises that purchase loans from lenders. These loans aren’t directly insured or guaranteed by the federal government but must conform to specific guidelines regarding loan amounts, borrower qualifications, and property requirements. It’s important to note that not all conventional loans are conforming; some are non-conforming but still considered conventional, such as jumbo loans.

Most lenders prefer conventional conforming loans because they can be sold on the secondary market, freeing up capital for additional lending. Borrowers benefit from competitive rates and flexible terms, though qualification requirements are typically stricter than government-insured or guaranteed alternatives.

The choice between conventional and government-insured or guaranteed financing depends on your financial situation, down payment capacity, and long-term plans. Government programs serve specific populations or circumstances, while conventional loans provide broader market access for well-qualified borrowers.

| Loan Type | Down Payment | Credit Score | Mortgage Insurance | Best For |

|---|---|---|---|---|

| Conventional | 3%-20% | 620+ | PMI if <20% down | Strong credit, flexible options |

| FHA | 3.5% | 580+ (500–579 with 10% down) | MIP required | Lower credit/income |

| VA | 0% | Flexible | None | Military/veterans |

| USDA | 0% | Flexible | Guarantee fee | Rural properties |

| Jumbo | 10%-20% | 700+ | Varies | High-value properties |

Jumbo Loans

Jumbo loans exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA) — not the FHA. For 2025, the standard conforming limit is $806,500 for single-family homes, though higher limits apply in designated high-cost areas. These non-conforming loans typically require larger down payments, higher credit scores, and more extensive documentation due to increased lender risk.

Borrowers seeking jumbo loans often face stricter qualification requirements, including debt to income ratios below 43% and substantial cash reserves. However, these loans enable purchases of high-value properties that wouldn’t qualify for conventional conforming financing.

The Mortgage Application Process

Securing a mortgage involves multiple steps designed to verify your ability to repay the loan and ensure the property provides adequate collateral. Lenders assess your gross income to determine how much you can afford to borrow and to calculate your debt-to-income ratio, which is a key factor in mortgage eligibility. Understanding this process helps you prepare effectively and avoid common delays that can jeopardize your home purchase.

The timeline from application to closing typically spans 30-45 days, though market conditions and loan complexity can extend this period. Most lenders recommend beginning the pre-approval process before house hunting to strengthen your negotiating position and identify potential issues early.

Pre-Qualification and Pre-Approval

Pre-qualification provides an initial estimate of your borrowing capacity based on basic financial information you provide to the mortgage lender. This informal assessment doesn’t involve credit checks or document verification but offers a starting point for your home search.

Pre-approval represents a more thorough evaluation where lenders review your credit report, verify income and assets, and issue a conditional commitment for a specific loan amount. This process strengthens your position with sellers and real estate agents while identifying any credit or documentation issues that need resolution.

Application and Underwriting

The formal application process requires extensive documentation of your financial situation, employment history, and the property you’re purchasing. Mortgage underwriters review this information against the lender’s guidelines and the specific loan type requirements.

During underwriting, expect requests for additional documentation, clarification of unusual deposits or credit issues, and verification of continued employment. The underwriter’s job is to ensure you meet all qualification criteria and that the loan complies with investor and regulatory requirements.

Property Appraisal

Lenders require professional appraisals to confirm the property’s value supports the loan amount. Licensed appraisers evaluate the home’s condition, compare it to recent sales of similar properties, and provide an independent value assessment that protects both borrower and lender interests.

If the appraisal comes in below the purchase price, you may need to renegotiate with the seller, bring additional cash to closing, or seek alternative financing. This protection mechanism prevents borrowers from overpaying and lenders from making loans that exceed the collateral value.

Required Documentation for Mortgage Applications

Successful mortgage applications require comprehensive financial documentation. Gathering these materials early in the process prevents delays and demonstrates your preparedness to potential lenders.

Essential documents include two years of tax returns and W-2 forms, recent pay stubs covering 30-60 days, bank statements for all accounts, and documentation of any additional income sources. Self-employed borrowers typically need additional documentation, including profit and loss statements and business tax returns.

Credit reports and scores play a crucial role in the application process, with minimum requirements varying by loan type. Conventional loans typically require scores of 620 or higher, while FHA loan programs accept scores as low as 500 with appropriate down payment amounts.

Mortgage Payment Components

Understanding your monthly mortgage payment structure helps you budget effectively and make informed decisions about loan terms and payment strategies. Using a mortgage calculator can help you estimate your monthly payment by factoring in principal, interest, taxes, insurance, and other costs. The typical payment includes several components beyond the basic principal and interest charges.

Principal and Interest

The loan principal represents the original borrowed amount, while interest constitutes the lender’s charge for providing the funds. In a traditional amortizing loan, each monthly payment includes both components, with the proportion shifting over time as you pay down the balance.

Early in the loan term, interest comprises the majority of each payment, while principal portions increase gradually. This amortization schedule means you build equity slowly at first, then more rapidly in later years as larger portions of each payment reduce the outstanding balance.

Property Taxes and Insurance

Most mortgage lenders require borrowers to maintain escrow accounts for property tax and insurance payments. These accounts collect monthly deposits equal to one-twelfth of the annual costs, ensuring funds are available when bills come due.

Property taxes vary significantly by location and home value, typically ranging from 0.5% to 2.5% of the property’s assessed value annually. Homeowner’s insurance costs depend on the property’s location, value, and coverage levels, but generally range from 0.3% to 1.5% of the home’s value per year. Homeowner’s insurance is an insurance policy designed to protect both the homeowner and the lender from losses due to damage or liability.

Private Mortgage Insurance

Private mortgage insurance protects lenders against losses if borrowers default on conventional loans with less than 20% down payment. PMI costs typically range from 0.5% to 1% of the original loan amount annually, paid monthly as part of the mortgage payment.

Borrowers can request PMI cancellation once they’ve paid down the loan to 80% of the original home value, provided they’re current on payments and meet the lender’s requirements. PMI automatically terminates when the balance drops to 78% loan to value based on the original property value under the Homeowners Protection Act (HPA). Some lenders offer lender-paid mortgage insurance (LPMI) options where they pay the premium in exchange for a slightly higher interest rate.

FHA Mortgage Insurance

FHA loans require mortgage insurance premium (MIP) payments regardless of down payment size. For loans with less than 10% down, MIP continues for the life of the loan, while loans with 10% or more down can have MIP removed after 11 years. This applies only to FHA loans originated on or after June 3, 2013.

The MIP structure includes both upfront and annual components. The upfront premium equals 1.75% of the loan amount, while annual premiums range from 0.45% to 1.05% depending on the loan term and down payment amount.

Insurance Alternatives

Some lenders offer lender-paid mortgage insurance (LPMI) where they pay the premium in exchange for a higher interest rate. This option eliminates the separate insurance payment but cannot be removed like traditional PMI, making it less favorable for borrowers planning long-term ownership.

Another alternative involves piggyback loans or 80-10-10 financing, where borrowers take a first mortgage for 80% of the home value, a second mortgage for 10%, and make a 10% down payment. This structure avoids mortgage insurance but involves managing two loans with potentially different terms.

Closing Costs and Fees

While your monthly mortgage payment is a major consideration when buying a home, it’s equally important to account for the closing costs and fees that come with securing a mortgage loan. These upfront expenses can significantly impact the total cost of your home purchase and should be factored into your budget from the start.

Closing costs typically include a variety of fees, such as the origination fee charged by the lender for processing your loan, appraisal fees to determine the property’s value, and title insurance to protect against ownership disputes. Other common costs may include credit report fees, attorney fees, and prepaid items like homeowner’s insurance and property taxes.

The exact amount you’ll pay in closing costs can vary based on your lender, the location of the property, and the type of loan you choose. Most lenders provide a loan estimate early in the process, which outlines all expected fees and helps you compare offers. Reviewing this document carefully ensures you understand your total financial commitment—not just your monthly mortgage payment.

By planning for closing costs and fees in addition to your monthly mortgage, you’ll have a clearer picture of what it truly takes to become a homeowner and can avoid surprises at the closing table.

Repayment Strategies and Options

Optimizing your mortgage payments can save thousands in interest and help you build equity faster. Paying your mortgage on time and in full each month is essential for maintaining good credit and avoiding penalties. Various strategies allow you to tailor your repayment approach to your financial situation and goals.

Standard Amortization

Most mortgages use standard amortization with equal monthly payments throughout the loan term. Early payments consist primarily of interest, while later payments apply more toward principal reduction. This predictable structure simplifies budgeting but results in slow initial equity building.

Understanding your amortization schedule helps you see how extra payments affect your loan balance and total interest costs. Even small additional principal payments can significantly reduce your loan term and total interest paid over time.

Bi-Weekly Payment Programs

Bi-weekly payments involve making half your monthly payment every two weeks, resulting in 26 payments annually equivalent to 13 monthly payments. This strategy can reduce a 30-year loan term by 4-6 years and save substantial interest costs.

For example, bi-weekly payments on a $400,000 loan at 6.5% could save over $89,000 in interest and reduce the loan term to approximately 25 years. However, ensure your lender applies the extra payment to principal rather than holding funds until the next month.

Extra Principal Payments

Making additional principal payments provides flexibility while accelerating loan payoff. Even an extra $200 monthly on a $400,000 loan can save over $89,000 in interest and reduce the loan term by more than six years.

The beauty of extra principal payments lies in their flexibility – you can make them when cash flow allows and skip them during tight months. This approach provides the benefits of faster payoff without the commitment of a shorter loan term.

Refinancing Considerations

Refinancing replaces your existing mortgage with a new loan, potentially offering lower rates, different terms, or cash-out options. Refinancing during periods of low rates can significantly reduce your monthly payment and total interest paid. Rate-and-term refinancing focuses on reducing your interest rate or changing the loan duration, while cash-out refinancing allows you to borrow against your home equity.

The decision to refinance depends on several factors including current rates compared to your existing rate, how long you plan to stay in the home, and the costs involved. Generally, refinancing makes sense when you can reduce your rate by at least 0.5% to 1% and plan to stay in the home long enough to recoup the closing costs.

Break-Even Analysis for Refinancing

Calculate your break-even point by dividing the total refinancing costs by your monthly payment savings. If refinancing costs $5,000 and saves $200 monthly, your break-even point is 25 months. If you plan to stay in the home longer than this period, refinancing likely makes financial sense.

Consider both the monthly savings and total interest savings over the remaining loan term. Sometimes refinancing to a shorter term with similar monthly payments can save substantial interest while building equity faster. Additionally, getting pre-approved for a Colorado Springs home loan can streamline the home-buying process and help you understand your financial options from the start.

Foreclosure and Default Consequences

Understanding the foreclosure process and default consequences helps borrowers recognize warning signs and explore alternatives before losing their homes. Foreclosure represents the legal process where lenders reclaim property after borrower default, but numerous options exist to avoid this outcome.

The Foreclosure Process

Foreclosure typically begins after 90-120 days of missed mortgage payments, though the exact timeline varies by state and lender policies. The process can take several months to over a year, depending on whether your state follows judicial or non-judicial foreclosure procedures.

Judicial foreclosure requires court supervision and tends to take longer, while non-judicial foreclosure follows procedures outlined in the mortgage documents. Both processes ultimately result in the lender taking ownership and selling the property to recover their investment.

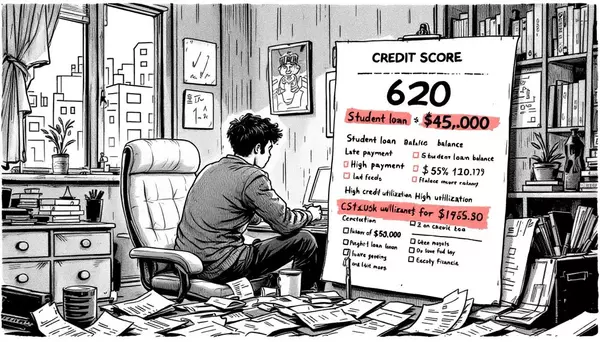

Credit Score Impact

Foreclosure devastates credit scores, typically dropping them by 200-400 points and remaining on credit reports for seven years. This damage makes it extremely difficult to qualify for new credit, including future mortgages, and can affect employment opportunities and insurance rates.

The credit impact begins with the first missed payment and worsens with each subsequent default. However, the foreclosure itself represents the most significant negative mark, making early intervention crucial for protecting your financial future.

Loss Mitigation Options

Lenders prefer to avoid foreclosure due to the costs and time involved, making them often willing to work with borrowers facing financial difficulties. Loss mitigation options include loan modifications, forbearance agreements, repayment plans, and short sales.

Loan modifications can reduce payment amounts through rate reductions, term extensions, or principal forgiveness. Forbearance provides temporary payment relief for borrowers experiencing short-term financial hardship, while repayment plans allow catching up on missed payments over time.

Short Sales and Deed in Lieu

Short sales allow borrowers to sell their homes for less than the outstanding mortgage balance with lender approval. While this option still damages credit, the impact is typically less severe than foreclosure and allows borrowers to potentially purchase another home sooner.

Deed in lieu of foreclosure involves voluntarily transferring property ownership to the lender to avoid the foreclosure process. This option provides a more controlled exit strategy but may still result in deficiency judgments in certain states.

Deficiency Judgments

In recourse states, lenders can pursue borrowers for the difference between the loan balance and the property’s sale price after foreclosure. These deficiency judgments can result in wage garnishment, asset seizure, and additional credit damage beyond the original foreclosure.

Non-recourse states generally prohibit deficiency judgments on purchase money mortgages, limiting lender recovery to the property itself. Understanding your state’s laws helps you evaluate the full consequences of default and foreclosure.

National Mortgage Regulations

Mortgage lending is shaped by a complex web of national regulations designed to protect both borrowers and lenders. In the United States, the federal government plays a significant role in setting the standards and guidelines that govern mortgage loans, impacting everything from mortgage rates to loan eligibility.

Key agencies like the Federal Housing Administration (FHA) and Freddie Mac help regulate the mortgage industry by insuring or purchasing loans, which encourages lenders to offer more flexible terms and lower down payments. These organizations set requirements for mortgage lenders, such as minimum credit scores, maximum loan amounts, and documentation standards, ensuring a level of consistency and safety across the industry.

For borrowers, understanding national mortgage regulations is crucial, as these rules can affect the types of loans available, the interest rates you’re offered, and the overall affordability of homeownership. For lenders, compliance with federal guidelines is essential to maintain their ability to originate and sell mortgage loans.

Staying informed about current mortgage regulations and how they influence mortgage rates and loan products can help you make smarter decisions when choosing a mortgage lender and navigating the home financing process.

International Mortgage Systems

Mortgage systems vary significantly across countries, reflecting different regulatory environments, economic conditions, and cultural approaches to homeownership. Comparing international systems provides perspective on the U.S. market and potential alternative structures. Each country’s housing market has unique characteristics that influence mortgage systems, interest rates, and associated costs.

Canadian Mortgage System

Canadian mortgages typically feature shorter amortization periods and different rate structures compared to U.S. loans. Most Canadian mortgages have 25-year amortization periods with five-year terms, meaning borrowers renegotiate rates every five years rather than locking in 30-year fixed rates.

This system exposes borrowers to more frequent rate risk but allows lenders to manage interest rate exposure more effectively. Canadian banks also face stricter capital requirements and stress testing, contributing to a more conservative lending environment.

United Kingdom Mortgage Market

UK mortgages predominantly feature variable rates tied to the Bank of England base rate or lender-specific rates. Fixed-rate periods are typically shorter than U.S. mortgages, commonly ranging from two to five years before reverting to variable rates.

Building societies, which are mutual organizations owned by members, play a significant role in UK mortgage lending alongside traditional banks. The UK system also features Help to Buy schemes and other government programs designed to assist first-time buyers in expensive housing markets.

European Mortgage Systems

European mortgage systems vary significantly by country, with some featuring covered bond financing that provides stable funding for long-term fixed-rate mortgages. German pfandbriefe and Danish mortgage bonds exemplify this approach, enabling 30-year fixed-rate mortgages similar to the U.S. system.

However, many European countries rely more heavily on variable-rate mortgages, and down payment requirements are often higher than in the United States. Government guarantee systems are less common, though some countries offer targeted programs for specific borrower groups.

Islamic Mortgage Alternatives

Islamic finance principles prohibit interest payments, leading to alternative mortgage structures that comply with Sharia law. These alternatives include murabaha (cost-plus financing), ijara (lease-to-own arrangements), and musharaka (partnership financing).

These structures achieve similar outcomes to conventional mortgages while adhering to Islamic principles about money, ownership, and risk-sharing. Growing Muslim populations in Western countries have led to increased availability of these alternative financing options.

Comparing International Systems

| Country | Typical Term | Rate Type | Down Payment | Government Role |

|---|---|---|---|---|

| United States | 30 years | Fixed/Variable | 3-20% | High (FHA, VA, USDA) |

| Canada | 25 years | 5-year terms | 5-20% | Moderate (CMHC) |

| United Kingdom | 25 years | Variable | 5-25% | Limited (Help to Buy) |

| Germany | 20-30 years | Fixed/Variable | 20-30% | Limited |

| Australia | 25-30 years | Variable | 5-20% | Limited |

|

Most countries require higher down payments than the United States and have less government involvement in mortgage markets. The U.S. system’s emphasis on long-term fixed-rate mortgages and government-backed lending is relatively unique globally, reflecting specific policy goals around homeownership promotion and market stability.

The secondary mortgage market, anchored by Fannie Mae and Freddie Mac, provides liquidity that enables the widespread availability of long-term fixed-rate mortgages. This system contrasts with many international markets where banks hold loans to maturity, limiting their ability to offer extended fixed-rate terms.

Understanding these international differences highlights both the advantages and potential risks of the U.S. mortgage system. While American borrowers benefit from long-term rate certainty and numerous government programs, they also face complex qualification processes and potential market distortions from government intervention.

Conclusion

Navigating the mortgage landscape requires understanding numerous interconnected factors, from basic loan structures to complex market dynamics. The mortgage you choose will likely represent your largest monthly expense for decades, making informed decision-making crucial for your financial success.

Key considerations include selecting the appropriate loan type for your situation, understanding all costs involved beyond the basic principal and interest payment, and developing a strategy that aligns with your long-term financial goals. Whether you choose a conventional mortgage with traditional terms or explore government-insured or guaranteed alternatives, ensure you understand the full implications of your decision.

The current market environment, with rates significantly higher than recent years, emphasizes the importance of shopping multiple lenders and considering various loan programs. Even small differences in rates or fees can translate to thousands of dollars over the life of your loan, making comparison shopping an essential part of the process.

Remember that your initial mortgage choice isn’t permanent – refinancing options allow you to adapt to changing circumstances and market conditions. However, building a strong financial foundation from the start, including adequate emergency reserves and realistic payment expectations, provides the flexibility to take advantage of future opportunities.

As you move forward with your mortgage decision, consider consulting with qualified professionals including mortgage lenders, real estate agents, and financial advisors who can provide personalized guidance based on your specific situation. The complexity of modern mortgage markets makes professional advice valuable for optimizing your home financing strategy and achieving your homeownership goals.

The post Mortgage 101 – Your Statring Guide To Home Finanace appeared first on 719 Lending.

Categories

Recent Posts