Best Tips on How to Purchase a House with No Money

Want to buy a house with no money? It’s possible through certain loan programs and creative financing. This article explains how to purchase a house with no money down, covering various options and strategies to make homeownership affordable.

Introduction to Buying a House

Buying a house is one of the most significant financial decisions you’ll ever make, and understanding the basics can make the process much smoother. Whether you’re a first-time homebuyer or looking to move up, it’s important to familiarize yourself with the key factors that influence your ability to purchase a home. Your credit score, debt-to-income ratio, and the amount you can put toward a down payment all play a crucial role in determining your mortgage options and eligibility.

There are several types of mortgage loans available to help you buy a house, each with its own requirements and benefits. FHA loans, backed by the Federal Housing Administration, are popular for their low down payment requirements and flexible credit standards. VA loans, available to eligible veterans and service members, often require no down payment and offer competitive terms. USDA loans are designed for buyers in rural areas and can also provide zero down payment options. In addition to these government-backed loans, there are conventional mortgage loans and a variety of payment assistance programs that can help cover down payments and closing costs.

Understanding these options and how they fit your financial situation is the first step in the home buying process. By exploring different mortgage options and payment assistance programs, you can find a path to homeownership that works for you, even if you have limited savings or a lower income.

Key Takeaways

- Zero-down mortgage programs, such as VA and USDA and even FHA with down payment assistance, provide opportunities for eligible homebuyers to purchase homes without a down payment, though they may come with higher interest rates and costs.

- Alternative financing options, like FHA loans and conventional loans, require minimal down payments and can help buyers who may not qualify for zero-down programs.

- Down payment assistance programs and creative financing solutions, such as silent second mortgages and family gifts, can significantly reduce upfront costs and make homeownership more attainable.

Can You Really Buy a House with No Money Down?

The idea of buying a house with no money down might seem too good to be true, but it is indeed feasible through specific loan programs designed for this purpose. A zero-down mortgage is a type of home loan that requires no money down at closing, making it an attractive option for many hopeful homeowners. However, like all things that sound too good to be true, there are pros and cons to consider.

One of the main advantages of a zero-down payment loan is that it removes the biggest barrier to homeownership: the down payment requirement. For many, saving up for a down payment is a daunting challenge that can take years. With zero down payment options, this obstacle is eliminated, making it easier for individuals, especially those with low income, to buy a house. Buyers may also consider making a smaller down payment, which can make homeownership more accessible, but comes with trade-offs such as higher mortgage insurance premiums or interest rates.

On the flip side, these loans typically often come with a higher interest rate and additional costs like mortgage insurance, which can increase the overall cost of the loan amount. No-money-down mortgages often come with lower upfront costs but may require higher monthly payments due to mortgage insurance. Buyers should be aware that a lower or zero down payment can result in a higher monthly mortgage payment, so it’s important to factor this into your budget.

Eligibility for no down payment mortgage loans varies by program, and not everyone will qualify. Specific criteria must be met, and these can include income limits, credit score requirements, and employment history. While the dream of homeownership without a down payment is attainable, it comes with its own set of challenges and costs that potential homebuyers need to be aware of before diving in. Using your own money for a down payment can affect your mortgage terms, interest rate, and how quickly you build equity in your home. Closing costs can still be significant when buying a house with no down payment, usually ranging from 2% to 6% of the purchase price.

Exploring Zero-Down Mortgage Options

Zero-down mortgage loan programs are designed to help qualified buyers purchase homes without needing an initial payment. These programs, such as VA loans and USDA loans, offer a pathway to homeownership that significantly lowers the financial barriers. VA loans are backed by the Department of Veterans Affairs and allow eligible buyers to purchase a home with no down payment. USDA loans are backed by the United States Department of Agriculture and are designed to promote affordable homeownership in rural areas. If qualified, individuals can finance 100% of the home’s purchase price through government-backed loan programs. For those eligible, these loans can make the dream of owning a home a reality without the immediate financial burden of a down payment.

VA loans are available to military service members, veterans, and their spouses, while USDA loans cater to buyers in rural areas. Both loan types require no down payment, making them ideal for those who qualify. Here are these options in more detail, including usda and va loans.

VA Loans for Veterans

VA loans are a fantastic benefit for those who have served in the military. Active duty service members, veterans, and eligible family members can qualify for a VA loan. This type of loan does not require a down payment. To apply, you’ll need to submit a Certificate of Eligibility (COE) and have sufficient income and credit, but once approved, the benefits are considerable.

One of the key advantages of VA loans is that they do not require private mortgage insurance, which can be a significant saving over the life of the loan. However, VA loans require a one-time VA funding fee, which replaces mortgage insurance and varies based on the loan type and borrower status. Additionally, VA loans can be used to purchase primary residences and small multi-family buildings with up to four units, providing flexibility for military families looking to invest in real estate. Buyers can also generate rental income by renting out additional units while living in one unit as their primary residence. USDA loans, on the other hand, typically have lower fees compared to other loans, making them another cost-effective option.

USDA Loans for Rural Areas

USDA loans are another excellent zero down mortgage option, specifically designed for buyers in rural areas. These loans provide 100% financing, meaning no down payment is required, which can be a game-changer for eligible rural homebuyers. To qualify, applicants must not exceed 115% of the median household income in their area and must demonstrate they can manage debt responsibly.

USDA loans are only available for properties located in eligible areas, which are specific rural or suburban zones designated by the USDA. It’s important to check if a property falls within these eligible areas to determine if you qualify for this government-backed mortgage program.

USDA loans can be used for various property types, including:

- Single-family homes

- Condos

- Manufactured homes as long as they are used as a primary residence. This flexibility makes a usda loan a viable option for many looking to buy a house in less urbanized regions.

Low Down Payment Alternatives

If zero-down mortgage options are not available or you’re not eligible, there are still plenty of low down payment alternatives to consider:

- FHA loans, which typically require at least 3% to 3.5% down

- VA loans, which also allow for low down payment home purchases

- USDA loans, another excellent option with minimal down payment requirements

These are specialized home loans designed to help buyers with limited savings or lower incomes achieve homeownership.

These options can make buying a house more money accessible for eligible buyers with little or no money without significant affordable housing savings.

Creative financing methods can also play a crucial role here. Borrowing money for down payments or putting money from a home equity line from another property can open up additional financing opportunities for rental properties. Borrowing from a 401(k) to finance a home purchase is another option, though it may have tax implications and impact investment growth.

Two popular low down payment options are FHA loans and conventional loans.

FHA Loans

FHA loans are designed to help homebuyers, particularly those with lower credit scores, access affordable mortgage options. Key points include:

- Minimum down payment requirement of 3.5%, making them a viable option for many buyers.

- To qualify for an FHA loan with the 3.5% down payment, a minimum credit score of 580 is required.

- For those with credit scores as low as 500, a larger down payment is necessary.

- Despite the larger down payment for lower scores, the initial costs remain higher.

FHA loans require mortgage insurance premium for the life of the loan if the down payment is less than 10%, adding to the overall cost of borrowing, including your mortgage payment and payment mortgages. This requirement ensures that the loans remain affordable and accessible while protecting lenders from potential losses. If you want to avoid additional costs, you may need to pay mortgage insurance.

Conventional Loans with Minimal Down Payments

Conventional loans can be obtained with as little as 3% down, making them an appealing option for buyers who prefer fewer restrictions. For well-qualified buyers, the minimum down payment for a conventional loan is just 3%, provided they meet the credit score requirement of at least 620.

Programs like Fannie Mae and Freddie Mac’s Home Possible are designed to assist buyers with minimal down payments, requiring only 3% down. Additionally, these programs allow sellers to contribute up to 3% towards closing costs, further reducing the financial burden on the buyer. HomeReady also allows counting income from a renter to increase your qualifying income, making it a flexible option for many buyers.

Leveraging Down Payment Assistance Programs

Down payment assistance programs (DPAs) and the payment assistance program are excellent resources for homebuyers looking to reduce their upfront costs. These programs can provide grants or zero-interest loans to cover down payments or closing costs. For low-income individuals, programs like the Housing Choice Voucher homeownership program can be particularly beneficial. For other flexible loan options, consider alternative financing solutions.

Applying for these programs requires providing detailed financial information and meeting specific eligibility requirements, which often include income and credit requirements. Let’s look at the types of assistance available through state, local, and non-profit programs. State and local down payment assistance programs (DPAs) help cover down payments and closing costs, making homeownership more attainable for many buyers. Some down payment assistance programs may require you to live in the home for a certain number of years to avoid repayment.

State and Local Programs

Many state and local programs offer assistance for down payments, which can help make homeownership more accessible. These programs often provide grants, such as $2,500 for qualifying borrowers with income at or below 50% of the area median income. Eligibility for these programs is typically easier for low-income borrowers, making them an invaluable resource. Many assistance programs do not require repayment if conditions are met, such as residing in the home for a set period.

Information on available assistance programs can usually be found through HUD’s database, providing a centralized resource for prospective buyers of HUD homes. HUD homes are properties sold at a discount after foreclosure through low-income home-buying programs. HUD defines low income as earning 80% or less of the area median income (AMI).

Non-Profit Organization Assistance

Non-profit organizations also play a crucial role in providing financial aid to help with down payments and closing costs for first-time buyers. These non-profits often offer grants and zero-interest loans, making the dream of homeownership more attainable for those without significant savings. Additionally, the Good Neighbor Next Door program provides discounts for teachers and first responders on HUD foreclosure homes, further supporting community-focused professionals in achieving homeownership.

Creative Financing Solutions

Creative financing solutions can significantly reduce the upfront costs associated with buying a home, making homeownership more accessible. Silent second mortgages and down payment gifts are two such solutions that can make the journey to homeownership more feasible for many buyers.

These methods help buyers overcome financial hurdles in purchasing a home. Here are the specifics of these creative financing solutions.

Silent Second Mortgages

A silent second mortgage is a second loan used for down payment that takes second priority to the main mortgage. These loans can provide the necessary funds for down payments without immediate repayment obligations, making them an attractive option for buyers.

Options for silent second mortgages include Fannie Mae’s Community Seconds and Freddie Mac’s Affordable Seconds, which are designed to help buyers cover down payments. However, it’s important to note that if you default on a silent second mortgage, the primary mortgage lender has first claim on home sale proceeds.

Down Payment Gifts

Family gifts can be a significant aid in purchasing a house, provided lenders are notified and the gifts meet specific requirements. When using a family gift for a down payment, a gift letter should be obtained to confirm that the funds are a gift and not a loan.

Lenders often have specific documentation requirements to ensure proper tracking of these funds, but using family gifts can help buyers meet their financial obligations without needing to repay the gift.

Using Home Equity

If you already own a home, your home equity can be a powerful tool when looking to buy a house. Home equity is the difference between your home’s current market value and the amount you still owe on your mortgage. You can tap into this equity in several ways, most commonly through a home equity line of credit (HELOC) or a cash-out refinance.

A HELOC allows you to borrow against your home’s equity, giving you access to funds that can be used for a down payment on another property or to cover other major expenses. Cash-out refinancing, on the other hand, replaces your existing mortgage with a new, larger loan, allowing you to take out the difference in cash. Both options can provide the funds needed to buy a house, but it’s important to weigh the risks—such as higher monthly payments or putting your current home at risk if you can’t repay the loan.

Before using home equity to buy a house, consider your long-term financial goals and consult with a mortgage lender to ensure this strategy aligns with your needs.

Unique Opportunities: HUD Homes

For buyers seeking affordable housing, HUD homes present a unique opportunity. These properties are owned by the U.S. Department of Housing and Urban Development (HUD) and are typically sold at prices below market value, making them an attractive option for budget-conscious buyers. HUD homes often become available after a foreclosure on an FHA-insured mortgage, and they can be found in a variety of neighborhoods, including those targeted for urban development.

One of the main benefits of purchasing a HUD home is the potential to secure a property at a lower price, which can make homeownership more accessible. Additionally, HUD may offer special programs or incentives for certain buyers, such as teachers, law enforcement officers, and first responders, further enhancing affordability.

However, it’s important to be aware that HUD homes are sold “as-is,” which means you may need to invest in repairs or renovations. Buyers should carefully inspect the property and budget for any necessary improvements. Working with a real estate agent experienced in HUD transactions can help you navigate the process and identify the best opportunities for affordable housing.

Strategies to Minimize Upfront Costs

Minimizing upfront costs when purchasing a home requires a strategic approach in the home buying process:

- Establish a detailed budget to determine how much house you can afford, considering all associated costs.

- Reduce closing costs by comparing lender fees.

- Seek the lowest rates to further decrease closing costs.

Starting to save early and strategically can help you manage down payment requirements effectively. Let’s explore ways to reduce upfront costs through seller-paid closing costs and utilizing tax credits.

Seller-Paid Closing Costs

Negotiating for sellers to pay closing costs can significantly lower a buyer’s out-of-pocket expenses. In FHA loans, sellers can contribute up to 6% of the sales price towards closing costs, providing substantial savings for the buyer.

The willingness of sellers to cover closing costs is typically higher in a buyer’s market compared to a seller’s market, and factors like the property’s marketability can also influence their decision.

Utilizing Tax Credits

Tax credits like the Low-Income Housing Tax Credit (LIHTC) can incentivize the creation or renovation of affordable rental units for low-income families. These credits are allocated by state agencies and prioritize projects that serve very low-income households, providing essential equity to the projects. Mortgage Credit Certificates (MCCs) offer an additional tax break that can increase your home-buying budget, making homeownership more accessible.

Preparing Financially for Homeownership

Preparing financially for homeownership involves more than just saving for a down payment. Consider the following:

- Include ongoing costs like insurance, taxes, and maintenance in your budget.

- Maintain savings and investment accounts, which can positively impact your eligibility for a zero-down mortgage.

- Have a reliable employment history to indicate your capacity to make mortgage payments.

Comparing loans from various lenders helps determine the best fit for your budget and access to programs. Let’s look at two crucial aspects of financial preparation: improving your credit score and reducing your debt-to-income ratio.

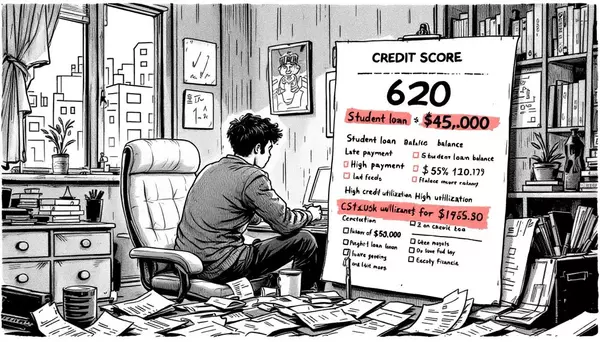

Improving Credit Score

Your credit score plays a pivotal role in securing a favorable mortgage. Timely bill payments are crucial as they significantly impact your credit score. Additionally, keeping your credit utilization low, ideally below 30%, is essential for maintaining a good score. Lenders look for borrowers who exhibit financial responsibility, and a high credit score can lead to better loan terms and lower interest rates.

Improving your credit score takes time and diligence, but the benefits are well worth the effort. Consistent, on-time payments and managing your debt wisely will not only improve your credit score but also enhance your chances of obtaining a mortgage with favorable terms.

Reducing Debt-to-Income Ratio

A lower debt-to-income ratio can greatly enhance your chances of mortgage approval and improve the terms of your loan. Managing existing debt is crucial, as it directly affects this ratio and influences lenders’ decisions. Reducing high-interest credit card balances can greatly enhance your debt-to-income ratio. This applies to other debts as well.

By reducing your debt-to-income ratio, you not only increase your chances of mortgage approval but also position yourself for better loan terms. This financial strategy is essential for anyone serious about securing a home loan with minimal upfront costs and favorable conditions.

House Hunting: Finding the Right Home

The search for the perfect home is both exciting and challenging. With so many real estate options available, it’s essential to approach house hunting with a clear plan. Start by identifying your priorities—such as location, size, school districts, and amenities—so you can focus your search on properties that meet your needs.

Researching neighborhoods is a crucial step in the home buying process. Consider factors like safety, proximity to work or public transportation, and future development plans. Working with a knowledgeable real estate agent can provide valuable insights into local market trends and help you find homes that fit your criteria.

When evaluating properties, pay close attention to the condition of the home, potential repair needs, and the overall value compared to similar homes in the area. Don’t hesitate to ask questions or request additional inspections to ensure you’re making an informed decision. By staying organized and working closely with your real estate professional, you’ll be better equipped to find a home that matches your lifestyle and budget.

Applying for a Mortgage

Securing a mortgage is a critical step in buying a house, and understanding the process can help you avoid surprises along the way. Start by researching mortgage lenders and comparing their rates, terms, and customer service. Gather all necessary documents, such as proof of income, tax returns, and credit reports, to streamline the application process.

There are several types of mortgage loans to consider, including conventional loans, FHA loans, VA loans, and USDA loans. Each loan type has its own eligibility requirements, down payment options, and benefits. For example, FHA loans are known for their low down payment requirements and flexible credit standards, while VA loans and USDA loans can offer zero down payment options for eligible buyers.

As you apply for a mortgage, be sure to understand the role of mortgage insurance, which may be required for loans with lower down payments. Factor in closing costs and other upfront costs, such as appraisal fees and title insurance, when budgeting for your home purchase. Your mortgage lender can help you navigate these expenses and explain your payment options.

By preparing in advance and understanding the different mortgage loans available, you’ll be in a strong position to secure financing and move forward with confidence in the home buying process.

Summary

Buying a house with no money down is not just a dream; it’s a feasible goal with the right knowledge and preparation. From understanding zero-down mortgage options like VA and USDA loans to exploring low down payment alternatives and leveraging down payment assistance programs, there are numerous pathways to homeownership. Creative financing solutions and strategic financial preparation can further reduce upfront costs and improve your chances of securing a mortgage. By taking these steps, you can turn the dream of owning a home into a reality.

This article was written by a personal finance writer with expertise in mortgages and home buying. All information provided is in accordance with equal housing lender standards.

Frequently Asked Questions

Can I buy a house with no money down?

Yes, you can buy a house with no money down through programs like VA and USDA loans, provided you meet their eligibility criteria. It’s important to explore these options thoroughly to ensure you qualify.

What are the risks of buying a house with no money down?

Buying a house with no money down poses risks such as higher interest rates, increased mortgage insurance costs, and potentially greater total interest payments over the loan’s life. It is critical to consider these factors before proceeding with such a financial commitment.

What is a silent second mortgage?

A silent second mortgage is a secondary loan utilized for the down payment that does not necessitate immediate repayment, holding a subordinate position to the primary mortgage.

How can I improve my credit score to qualify for better mortgage terms?

To improve your credit score for better mortgage terms, ensure that you make timely bill payments and keep your credit utilization low. These practices are crucial for enhancing your creditworthiness.

Are there programs that assist with down payment and closing costs?

Yes, there are numerous state, local, and non-profit programs that provide down payment assistance, including grants and zero-interest loans. These resources can significantly ease the financial burden of purchasing a home.

The post Best Tips on How to Purchase a House with No Money appeared first on 719 Lending.

Categories

Recent Posts